China’s debt-to-GDP ratio climbs to record 287.8% in 2023.

Budget 2024 Expectations Highlights:

Finance Minister will present an Interim Budget for 2024 as it is election year.

Highlights: The Union budget holds a significant position in the financial calendar, sparking increased anticipation regarding the government’s expenditures, fiscal deficit, and personal taxation.

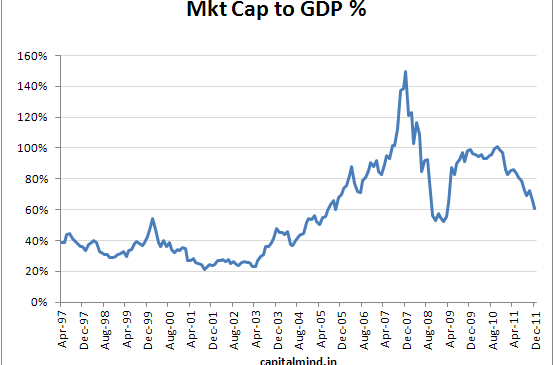

Street expects FY25 nominal GDP growth at 10%-11.5%. Market participants are eagerly awaiting the nominal GDP growth estimate for 2024-25.

India’s nominal GDP is seen growing by 8.9 percent this year to Rs 296.58 lakh crore. The ministry had assumed in its calculations that the nominal GDP would grow 10.5 percent this year to Rs 301.75 lakh crore.

Brokerages seem a little more optimistic and their estimates lie anywhere between 10 percent and 11.5 percent.

Centre rapidly brought down its fiscal deficit to an expected 5.9 percent of GDP this year from 9.2 percent in 2020-21.

Indian economy to grow at 7% in FY24

“It now appears very likely that the Indian economy will achieve a growth rate at or above 7% for FY24, and some predict it will achieve another year of 7% real growth in FY25 as well. If the prognosis for FY25 turns out to be right, that will mark the fourth year post-pandemic that the Indian economy will have grown at or over 7 per cent,” the Ministry of Finance has said in its review of the Indian economy released today.

CII suggests tax changes ahead of interim budget

— Tax exemption limit for individuals must be increased and linked with inflation

— Review capital gains tax structure by bringing consistency in tax rates for different asset classes such as debt, equity and immovable assets

Boost manufacturing, says Industry lobby

–Extension of the concessional tax regime for setting up of new manufacturing facilities for another five years

–Production Linked Incentive should be expanded to labour intensive sectors, such as apparel, toys, footwear, and chemicals.

Investment expectations of Confederation of Indian Industry (CII) lobby

–Continue spending on infrastructure, expand incentives for manufacturing and tweak import taxes on inputs for certain goods.

–Continue to focus spending on infrastructure and increase it by at least 20% to 12 trillion Indian rupees

–Continue to extend support to states in the form of interest free 50-year loans, and increase the allocation by 23% to 1.6 trillion rupees in 2024/25.

Evergrande: Crisis-hit Chinese property giant ordered to liquidate

All about partition of a HUF: 1. Section 171: Section 171 of the Income Tax Act, 1961 defines the partition …

Taxability of gifts during Diwali and marriage: Taxation of Diwali gifts: 1. If the value of gifts received from non-relatives …

Prime Minister Narendra Modi launched the ‘Pradhanmantri Suryoday Yojana,’ offering free rooftop solar to 10 million households. Know the cost …

The US economy’s strong performance in 2023, along with the challenges faced by China’s economy, suggests that China’s GDP overtaking …

Here are 20 effective strategies to generate leads from Instagram for any type of businesses ✔️Optimize Your Bio: Make your …

German business morale unexpectedly worsened in January, declining for the second month in a row as Europe’s largest economy struggles …

Financial News Bulletin Dt.26th January ,2024