China On Track To…..Over 230 home developers filed for bankruptcy in China last year:

China’s real estate sector’s contribution to GDP was 35.8 percent in 2016, 32.9 percent in 2017, 29.6 percent in 2018, 28.7 percent in 2021 and 26.9 percent in 2022.

Amid the economic crisis in China, an estimated 233 home developers filed for bankruptcy last year

◆ Forty years of continuous growth has transformed China into one of the world’s two largest economies.

◆ China Evergrande, Facing $300 Billion in Debt, Has Been Ordered to Liquidate

◆ 408 home developers filed for bankruptcy in 2020, the first year of the Covid-19 pandemic.

◆ 343 home developers filed for bankruptcy in 2021,

◆ 308 home developers filed for bankruptcy in 2022.

◆ Chinese property developer Country Garden reportedly set to avert yuan bond default

Forty years of continuous growth has transformed China into one of the world’s two largest economies. This is a remarkable achievement that has lifted hundreds of millions of people out of poverty and into the global middle class, consistently surpassing expectations and confounding those who predicted an economic bust.

■ The Country Garden developer, which employs some 300,000 people, has a massive debt pile that’s being compared to that of Evergrande, the world’s most indebted property group.

■ The highest number of bankruptcy applications were received from the Zhejiang province with 36 cases, accounting for 15.45 per cent of the nation’s total. Hunan and Guangdong provinces were second and third, respectively.

■ The economic downturn caused home developers in third- and fourth-tier cities to suffer the most. Even so, the overall impact of bankruptcies is expected to be limited.

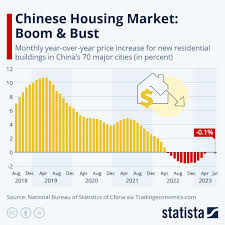

■ Home sales in China continued to dwindle in 2023 and challenges would persist in 2024 despite favorable policies. Low consumer confidence and inventory overhang mean China’s housing market could remain sluggish for a long while.

■ Earlier last year, a US-based news daily, reported that the construction sites around China appear visibly less busy and construction of apartment towers has faltered because of falling apartment prices.

■ Prices of existing homes in 100 cities across China fell an average of 14 per cent by early August from their peak two years earlier, according to the Beike Research Institute, a Tianjin research firm. Rents have fallen five per cent.

■ Apart from this, China’s banking sector is also struggling with the repayment of debt payments from defaulters as loans that banks have made to property developers have been defaulted.

Earlier, the central bank, the People’s Bank of China, announced that it was freeing banks to set aside smaller reserves and start extending more credit. The move was widely seen as intended to accommodate a large batch of bonds that local and provincial governments will issue to pay for their infrastructure projects.