Sec 92BA of the Income Tax Act: Section 92BA defines specified domestic transactions that are governed by the Transfer Pricing provisions, which include the domestic transactions related to any of the following activities in the case of an assessor:

1. Some expense incurred or incurred in conjunction with a payments made or to be made to an individual referred to in point (b) of section 40A(2).

2. Transactions related to in Section 80A.

Some transaction related to business between the assessee and another individual referred to in Section 8 of Section 80 IA.

3. Every activity referred to in section VI-A or section 10AA, or an individual to whom the requirements of subsection 8 or subsection 10 of section 80 IA relate.

4. And where the total of such payments entered into by the assessee in the intervening year reaches 20 crores.

5. Any other transactions that may be recommended

What is the Threshold Limit has been prescribed in the law?

1. The provisions referred to above shall apply only if the aggregate value of the turnover of the transactions referred to above exceeds Rs. 20 crore A.Y. 2017-18 onwards.

2. If the threshold has been reached, the consumer will be expected to conform with the Transfer Pricing provisions for all purchases, despite the fact that the volume of transactions under any head may be low. There is therefore no criterion for each head of the description.

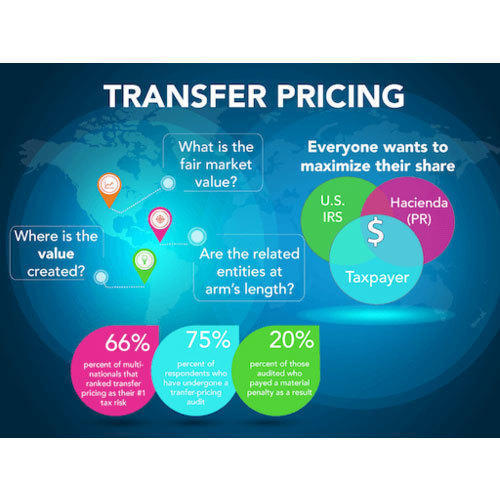

Applicability of Domestic Transfer Pricing?

1. Monetary threshold limit of 20 crores is to be calculated on the basis of the aggregate of payments and receipts to which these provisions apply.

2. Definition of Related party includes expenses disallowed to cover the entities which have common beneficial ownership

3. Transfer pricing is mostly applicable to international transactions and specified domestic transactions and specifically excludes Advance Pricing Agreement provisions.

Concept of Arm’s Length Price(ALP)

The concept of ALP has also been extended to Specified Domestic Transactions. ALP is defined as the price which is applied to proposed to be applied in a transaction the assessed and any other unrelated person in uncontrollable condition

Methods of Computing ALP

1. Comparable uncontrolled price method

2. Resale price method

3. Cost plus method

4. Profit Split method

5. Transactional net margin method

6. Such other method as may be notified by the Board